Between the start of April and the end of November 2025, VMI celebrated an extraordinary milestone, one that few companies achieve: 80 years of successful innovation, service and growth- all around the world. From a small workshop in the rural peace and quiet of Gelderland, the Netherlands, VMI has grown into a global player, with operations on almost every continent and a key role in driving growth and quality improvement across the Tire, Rubber, and other industries worldwide.

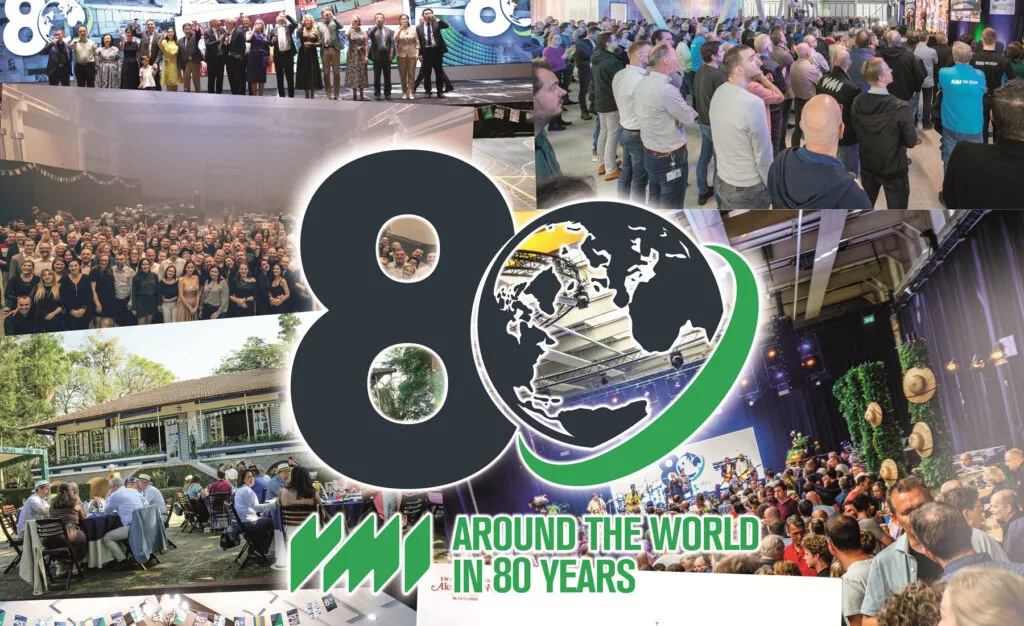

Around the World in 80 Years

This was the theme for the year, with celebrations in every major location, attended by country management, members of the Board and the company’s employees. The celebrations began on April 1st, when every part of the company came together online, before moving into large-scale events and parties in Yantai (China), Stow (US), Itatiaia (Brazil), Leszno (Poland) and Vadodara (India), with a special highlight of the campaign being an epic Family Day in Epe, in which over 3,000 people took part.

This event, bringing together not just VMI employees but their wider families as well, perfectly illustrates what was so special about the whole campaign. It was about global presence, for sure, a celebration of just how far VMI has travelled in scale and reach, and yet it was supremely a tribute to our people. To all those special human beings who helped build the company over 8 decades, to the families who supported them every step of the way, and to the rich and inclusive culture that makes VMI unique.

Harm Voortman, VMI’s CEO, comments: “VMI is a global business, but we are also truly local in every country where we operate. We pride ourselves on being professional, rigorous and always working to the highest standards, but also welcoming, open and friendly to everyone”.

Above all, Around the World in 80 Years celebrates decades of continuous, relentless innovation. VMI has been built on a strong foundation of exceptional ideas, deep insights, original thinking, an uncompromising commitment to R&D, and a constant stream of high-quality products, designed to enhance and support the markets and customers we work with.

This was also the year when VMI received the gold EcoVadis award, celebrating yet another special achievement: recognition as one of the most sustainable and environmentally responsible manufacturers of them all.

As Mike Norman, Chief Commercial Officer, comments: “This great milestone has been reached, and VMI is already looking forward to new challenges, new achievements and more celebrations- with innovation as the key to success in the future, just as it has been for the past 80 years”.